Latest topic: High Growth 40 in Cloud

High Growth 40 in Cloud

IT Europa's High Growth 40: Cloud analyses a cohort of financially thriving MSPs that cite cloud as the cornerstone of...

Channel Business Insights

Channel Executive Q&A

Features

Events

Opinion Pieces

In other news

Markets round-up for the week: 27 October

Big channel players continue to grow their markets through new technology, alliances, integrations and acquisitions

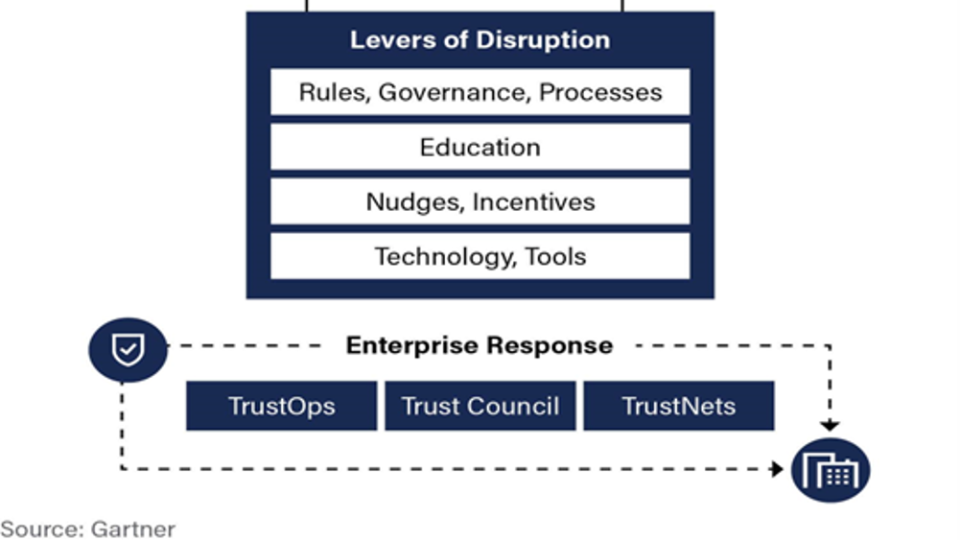

Trust economy to grow to $30bn, predicts Gartner.

Enterprises will spend more than $30bn combatting misinformation and disinformation by 2028, says a new book by Gartner.

Windows 10 withdrawal presents digital inclusivity opportunities, says Rebooted

Cambridge charity Rebooted is urging businesses to donate laptops following the Windows 10 withdrawal to support young people who are offline in the UK.

Scotland shows off sovereign and green AI cloud

Governments and enterprises should want to keep critical and sensitive AI data within their countries, and this project is a UK start.

European partners offered cloud-based print management by TD SYNNEX

Most printers are not managed or secured, this deal promises to change things for the better

Commvault appoints its Northern Europe leader

A new area vice president is also joined by a new field CTO

ExaGrid widens support for MSPs with its backup hardware

Data management and cyber protection hardware vendor fleshes out MSP offering

Veeam extends its cloud workload support for MSPs

Backup and cyber protection player unleashes a new MSP offering

BDR Group adds Eloquent Technologies to portfolio

BDR Group has acquired Eloquent Technologies, in a move that marks another significant milestone in BDR’s 2025 growth strategy, expanding its expertise and presence within the professional services sector.

Westcon-Comstor joins Proofpoint in expanded AWS Marketplace deal

Westcon-Comstor is building on a successful relationship and is expanding its relationship with Proofpoint, through a new AWS Marketplace agreement designed to offer seamless transactions and accelerate channel partner growth.