The worldwide server market grew 19.8% Y/Y to $24B in Q2, according to IDC data.

Server shipments were up 18% to nearly 3.2 million units.

In terms of server class, volume server revenue was up 22.1% to $18.7 billion, while midrange server revenue declined 0.4% to about $3.3 billion and high-end systems grew by 44.1% to $1.9 billion. EMEA sales fell back by almost 6%, with Asia/Pac growing fastest at over 30%.

"Global demand for enterprise servers was strong during the second quarter of 2020," said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC. "We certainly see areas of reduced spending, but this was offset by investments made by large cloud builders and enterprises targeting solutions that support shifting infrastructure needs caused by the global pandemic. Investments in Asia/Pacific were also particularly strong, growing 31% year over year."

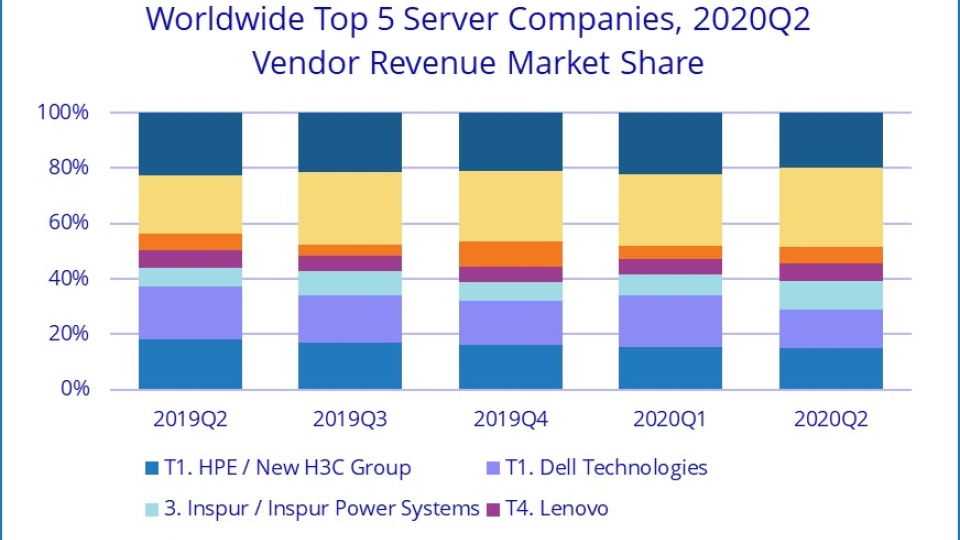

Hewlett Packard Enterprise and Dell were in a statistical tie for the top vendor spot, capturing market shares of 14.9% and 13.9%, respectively. Dell's server revenue was down 12% in Q2, while HPE's sales dropped 2%.

Inspur took second place with a 10.5% market share and 77% Y/Y revenue growth.

Lenovo and IBM tied for fourth with 6.1% and 6% shares, respectively. Lenovo's sales were up 21% and IBM increased 22%.