Decoupling hardware and software moves to a quarter of data centre ports, says forecast

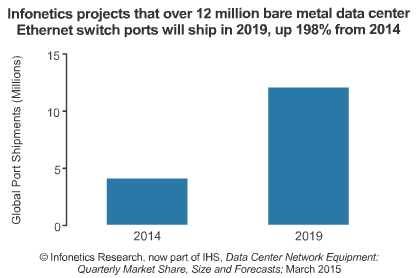

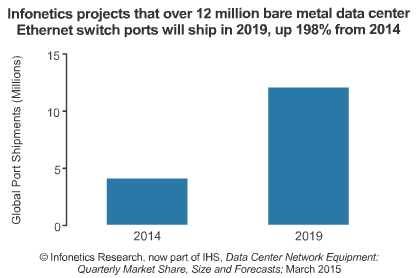

Decoupling hardware and software moves to a quarter of data centre ports, says forecast Bare metal switches, which decouple hardware from software and offer greater agility and cost savings over traditional data centre switches, will make up just under a quarter of all data centre ports shipped worldwide in 2019, up from 11% in 2014, says technology market research firm Infonetics Research. Global data centre network equipment revenue-including data centre Ethernet switches, ADCs and WAN optimisation appliances (WOAs) - grew 8% in 2014 from 2013, to $11.2bn, it says.

Infonetics' fourth quarter 2014 (4Q14) and year-end Data centre Network Equipment vendor market share, size and forecast report tracks data centre Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and wide area network (WAN) optimization products. In the fourth quarter of 2014 (4Q14), the data centre Ethernet switch market was up 5% sequentially, affected positively by CSP and financial institution spending.

"Up till now, bare metal switching has been attractive mainly to the large cloud service providers (CSPs) like Google and Amazon who provide their own switch software integrated into data centre orchestration and management platforms. But with vendors such as Dell and HP jumping into the mix with branded bare metal switches, adoption of bare metal switching is going to accelerate as tier 2 CSPs and large enterprises endeavour to achieve the nimbleness demonstrated by Google," said Cliff Grossner, directing analyst for data centre, cloud and SDN at Infonetics.

Following double-digit increases in 2011 through 2014, long-term growth in the data centre market is expected to slow down by 2019, braked by the migration to software-defined networking (SDN) and the shift to the cloud. Interest in optimising the WAN via software-defined WAN (SD-WAN) is strong, but the WAN optimisation segment has yet to return to long-term growth.

25GE ports will begin shipping in 4Q15, representing a new 25/100GE architecture for data centre fabrics targeted at large CSPs, a key high-end market segment