On the IT Press Tour of Silicon Valley last week, IT Europa heard about a number of channel opportunities around data management, storage and security.

We have already reported opportunities in relation to HYCU, N-able, Protocol Labs and GRAID Technology, but there were others too.

Pavilion Data

Unfortunately, just before we were due to meet them, high-performance flash storage firm Pavilion Data ceased trading, apparently due to the company leadership failing to find an adequate buyer for the firm, and hitting a brick wall when it came to finding new investment – after previously raising a total of around $100m in recent years.

Most of its 100 staff have been laid off and its channel scale-up plans now lay in tatters. In May 2019, we reported that Pavilion planned to distribute its NVMe-oF storage platforms to the European market through Business Systems International (BSI), with a focus on financial organisations as customers.

While Pavilion’s efforts have come to an end, we did however meet two hardware/software storage firms who were looking to expand their channel.

SmartIOPS

Despite its inception about nine years ago, SmartIOPS effectively came out of stealth mode on the IT Press Tour, after generating its first enterprise revenue only last year. The company says it has 17 US patents for its TrueRandom flash I/O systems, which target the markets connected to database acceleration, gaming, CDN and AI/ML, for instance.

It says it has raised around $20m so far, and is targeting a $100m funding round next year, partly on the basis of incoming customer sales it expects to achieve from companies including Oracle Cloud, NASA, Verizon, the US Department of Energy, China Telecom and China Mobile.

SmartIOPs says it already has a small channel in the EMEA region using Spectrum Electronics in the UK and France, and is looking to scale that up with new partners.

ScaleFlux

Also expanding on the flash hardware/software side is ScaleFlux, which operates in similar markets as SmartIOPS, including a focus on database acceleration. But it also has a new sales target in the edge market, driven by its technology being used in some systems sold by edge specialist Scale Computing.

ScaleFlux customers already include the likes of T-Mobile, Tencent, Alibaba Group, DreamWorks and Nvidia, with the supplier trumpeting the “ease-of-use” of its single-chip architecture that comes with a standard driver that requires no extra software or APIs to be loaded.

The firm is now pulling away from direct selling to reach the enterprise and data centre markets with its new global go-to-market, involving resellers, OEMs, system integrators and major server vendors.

Panzura

We also met cloud data management software vendors Panzura and Data Dynamics.

Panzura targets large enterprise deployments and has a pedigree in this field going back a number of years, although its ownership has recently changed.

The company focuses on the banking, health, manufacturing, media and public sector segments, for instance, and also has a ransomware story as well as a data management one. It reckons its ransomware mitigation feature can figure out where an attack is coming from “within two seconds” of being discovered on the network, which helps with restricting and managing the attack.

One of its recent deals is with a UK police force, which was arranged through international MSP Claranet, and the firm says it is looking for more partners aided by distributors, including Ethos in the UK and international player Climb Channel Solutions.

It adds that 98% of its new lead generation is coming from the channel, with the big three cloud hyperscalers among its Alliance Partners.

Data Dynamics

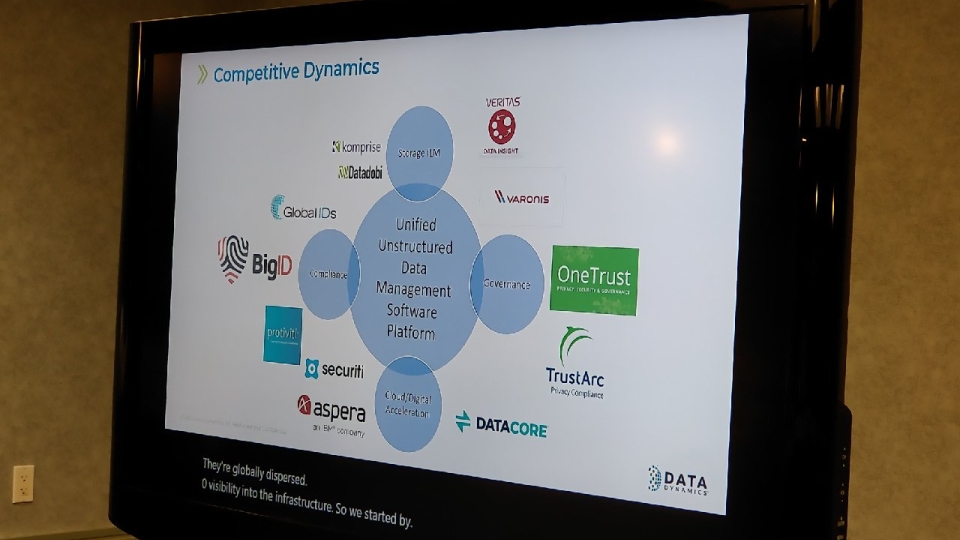

Data Dynamics provides a “unified unstructured data management platform”, and aims to close some of the data management holes many of the industry’s bigger names struggle to address (see diagram above).

It also enables customers to reduce their TCO by moving data to under-utilised storage platforms that they are paying for.

It already has GTM partnerships with the likes of Microsoft in the cloud, system integration deals with HCL, Capgemini and TCS, for instance, and storage solution alliances with the likes of NetApp, Dell EMC and VAST. In addition, Computacenter is one of its VARs.

To help drive business among these, and the new partners it plans to take on, the company has brought out a “risk calculator” to work out industry verticals’ specific risks among their files, enabling them to put in extra security over the most important ones.