Europe’s IT distributors recorded revenue of €1.8bn for the second week in a row as the channel continued its strong start to 2021, according to the latest data from CONTEXT, the IT market researcher. The strong performance in week three followed guidance from CONTEXT last week which predicted year-on-year channel sales growth of between 6% and 12% this quarter.

The same story can be seen in CONTEXT’s Weekly Revenue Trend Index, which compares current performance against a value of 100 for each country derived from an average four weeks in 2019. Of the largest European markets, it reveals double-digit revenue growth in week three over the 2019 average for Poland (42%), Italy (37%), Spain (31%), Germany (20%) and France (10%). Only the UK disappointed, with figures just under the 2019 average.

There was also strong performance from certain industry sectors, led by mobile computing and computing accessories, which both recorded 44% revenue growth versus average figures for 2019. Software (35%), AV systems (35%) warranties (21%) and telecoms (16%) also showed strong growth.

Mobile computing and computing accessories appear to be benefitting from continued lockdowns in much of Europe, which is driving demand from home workers and students. The sectors recorded revenue growth of 70% year-on-year in the four weeks to week three.

Within mobile computing it was tablets that led the way, with year-on-year growth over the same period in excess of 80%, with notebooks just behind on around 70% and monitors just under 70%.

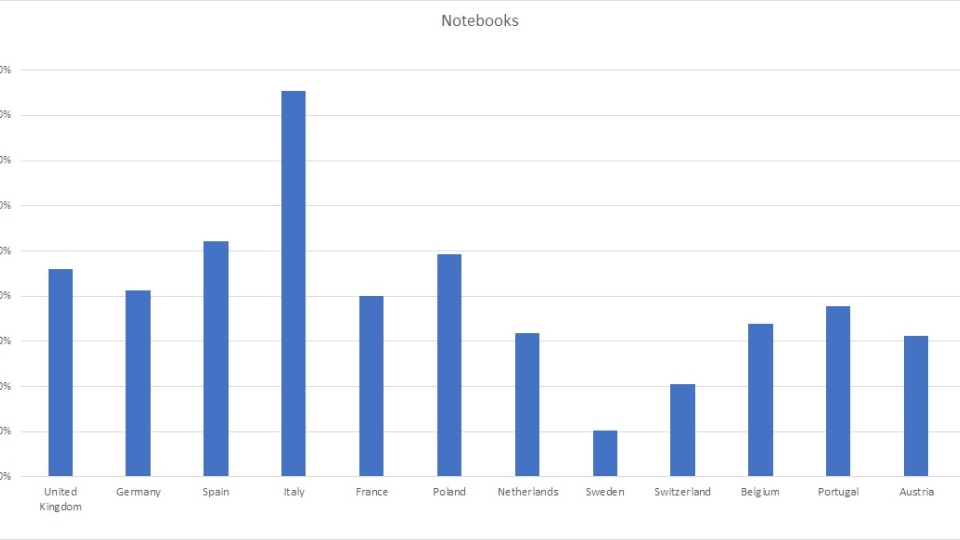

Interestingly, two trends are emerging with regard to the average purchase price* index for notebooks. In the five main economies of Europe, pricing has been strengthening over recent weeks, led by France. However, in the UK, the government’s deal with suppliers to provide free laptops to schools late last year drove the APP down considerably, and it now sits below the 2019 average.

“Europe’s distributors continue to get the year off to a flying start, with the kind of revenue figures we’d expect in weeks seven or eight rather than at this point in Q1,” said CONTEXT Adam Simon, Global MD at CONTEXT. “Home working categories like notebooks and tablets are driving unprecedented growth this early in a new year, but we’re also seeing the impact of supply shortages pushing average purchase prices up in some categories.”