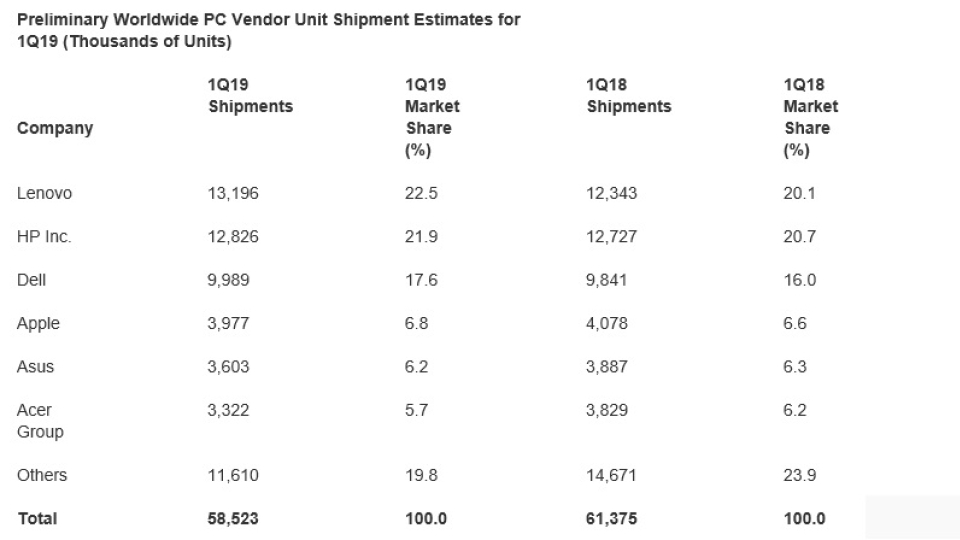

Global PC shipments declined 4.6% yr/yr in Q1 to 58.5 million shipments, according to new Gartner data. While shipments rebounded in mid-2018, anticipated CPU shortages from Intel impacted all PC markets.

PC shipments in EMEA totaled 18 million units in the first quarter of 2019, a 2.2% decline year over year. Enterprise shipments increased as many companies moved ahead with Windows 10 deployments. However, consumer PC demand remained weak as users are not replacing older PCs and are not migrating to hybrid systems, which have not gained wide adoption in EMEA as users continue to prefer larger screens, it says.

Lenovo, HP, and Dell accounted for nearly 62% of the Q1 shipments, up from 57% in last year's quarter. Lenovo remained in the top spot in the first quarter of 2019 with the largest year-over-year growth among the top vendors. However, Lenovo benefited from the inclusion of Fujitsu's shipments from its 2Q18 joint venture. Lenovo's shipments increased in EMEA and Japan, where Fujitsu had a larger presence.

HP Inc.'s worldwide PC shipments increased 0.8% in the first quarter of 2019 versus the same period last year. The company saw an increase in desktop shipments while mobile PC shipments remained flat. HP Inc. recorded a small increase in shipments in EMEA, but experienced a decline in all other regions.

"We saw the start of a rebound in PC shipments in mid-2018, but anticipation of a disruption by CPU shortages impacted all PC markets as vendors allocated to the higher-margin business and Chromebook segment," said Mikako Kitagawa, senior principal analyst at Gartner. "While the consumer market remained weak, the mix of product availability may have also hindered demand. In contrast, Chromebook shipments increased by double digits compared with the first quarter of 2018, despite the shortage of entry-level CPUs. Including Chromebook shipments, the total worldwide PC market decline would have been 3.5% in the first quarter of 2019."

Moreover, the constraints resulted in the top vendors shifting their product mix to the high-end segment in order to deal with the constraint — which, along with favorable component price trends, should boost profit margins, it says.