Standard servers dominate growth figures as average prices fall

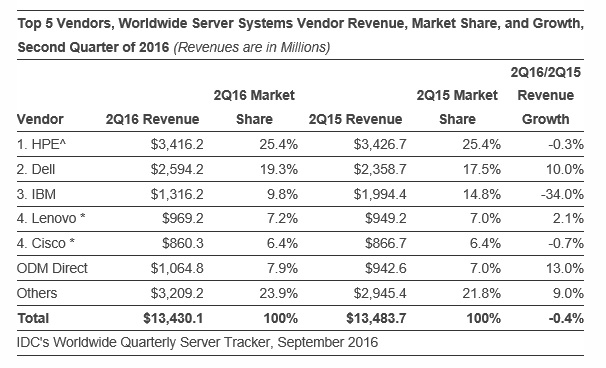

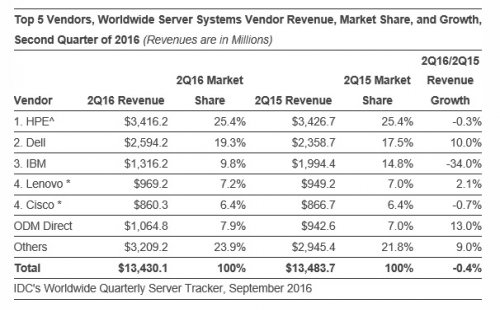

Standard servers dominate growth figures as average prices fall Overall server market growth has recently slowed in part due to a pause in hyperscale datacentre expansion and is feeling the continued drag from high-end server sale declines. According to the IDC Worldwide Quarterly Server Tracker, vendor revenue in the worldwide server market declined 0.4% year on year to $13.4 billion in the second quarter of 2016 (2Q16). Other significant findings include the flattening of Cisco's growth after years of steady increases and the return of double-digit ODM Direct (specialist data centre server) growth after a brief pause in 2016Q1. In addition, the robust enterprise refresh cycle of 2015 will create difficult comparisons in 2016 to the prior year’s quarterly results, it says. Worldwide server shipments increased 2.6% to 2.4 million units in 2Q16 when compared with the same year-ago period.

Demand for x86 servers improved in 2Q16 with revenues increasing 7.3% year on year in the quarter to $11.6 billion worldwide while unit shipments increased 2.7% to 2.3 million servers. HPE led the x86 server market with 28.0% revenue share based on 0.3% year on year revenue growth. Dell retained second place, securing 22.4% revenue share following 10.0% year on year revenue growth.

On a year-over-year basis, volume system revenue increased 5.3% and midrange system demand increased 12.7% in 2Q16 to $10.6 billion and $1.3 billion, respectively. Midrange systems were helped by enterprise investment in scalable systems for virtualisation and consolidation, as well as increases in x86-based mission critical systems. Meanwhile, 2Q16 demand for high-end systems experienced a year on year revenue decline of 31.4% to $1.6 billion on a difficult compare to the prior year. IDC expects continued long-term declines in high-end system revenue.

"The server market is progressing exactly as expected, with close to flat growth in the second quarter, following a difficult first quarter, but growth in volume servers is still healthy, which is a good sign for the market moving forward," said Kuba Stolarski, research director, Computing Platforms at IDC. "As we prepare for the second half of 2016, expect to see market growth led by cloud datacenter buildouts from key hyperscalers. Looking out further, the market will be impacted by digital transformation initiatives, including the Internet of Things and cognitive computing, and by a continuing shift towards software-defined infrastructure."

Hewlett Packard Enterprise (HPE) retained the number 1 spot in the worldwide server market with 25.4% market share in vendor revenue for 2Q16, as revenue decreased 0.3% year on year to $3.4 billion. HPE's year-on-year growth rate as reported by IDC was impacted by the start of the H3C partnership in China that began in May of 2016; as a result, a portion of HPE-designed servers were rebranded as H3C for the China market. Had these systems been branded as HPE servers, their worldwide server market share would have been 26.6% in vendor revenue for the quarter as revenue increased 4.2% year on year to $3.6 billion.

Dell maintained its number 2 position in the worldwide server market, building on server revenue growth of 10.0% year on year to $2.6 billion, resulting in 19.3% vendor revenue market share in 2Q16. IBM retained the number 3 position with 9.8% share for the quarter as revenue decreased -34.0% year on year to $1.3 billion in 2Q16, as both POWER systems and system z mainframes experienced double-digit declines. Lenovo and Cisco tied for the number 4 position for the second consecutive quarter with 7.2% and 6.4% market shares, respectively. Lenovo earned $969 million in revenues following an increase of 2.1%, while Cisco's revenues declined 0.7% year on year to $860 million.

"This quarter we saw well-established trends continue, such as the ongoing market shift towards x86 platforms over non-x86 large systems," said Jorge Vela, senior research analyst, Computing Platforms. "In the x86 market, tower servers continue to lead declines among form factors, while rack and density-optimized servers continue their steady growth as hyperscalers expand their reach and offerings. Globally, the China market continues its steady rise, growing at an impressive 19.2% for the quarter and fuelling much of the growth in the Asia/Pacific region. Other significant findings include the flattening of Cisco's growth after years of steady increases and the return of double-digit ODM Direct growth after a brief pause in 2016Q1."

Central and Eastern Europe (CEE) declined 1.3% and Western Europe declined 3.2%. Japan, Middle East and Africa (MEA) and Latin America experienced the largest year-over-year revenue declines, with 10.1%, 8.5% and 7.5% declines, respectively. The United States and Canada experienced slight declines at 0.7% and 0.6%, respectively.

Non-x86 servers experienced a revenue decline of 31.1% year on year to $1.9 billion, representing 13.9% of quarterly server revenue. IBM leads the segment with 70.6% revenue share despite a 34.0% year-over-year revenue decline. IDC also continued to track minimal revenue from ARM-based server sales in 2Q16; ARM sales have yet to make an impact on the server market.