International software services firm Noventiq is de-listing from the London Stock Exchange, as previously announced, and instead listing on the US Nasdaq, with a planned equity market capitalisation of $1 billion.

Noventiq says it is on track to report record turnover of around $1.5 billion, with an expanding recurring revenue base.

It operates in almost 60 countries with 75,000 customers, and has strategic partners including Microsoft, Amazon Web Services and Google.

The listing on the Nasdaq is being done through a SPAC (special purpose acquisition company) vehicle named Corner Growth Acquisition Corp, set up for the transaction/IPO (initial public offering).

The “new” company will operate under the same management team, including Hervé Tessler, chief executive officer, and Sergey Chernovolenko, president and chief operating officer, with current Noventiq shareholders rolling 100% of their equity into the venture.

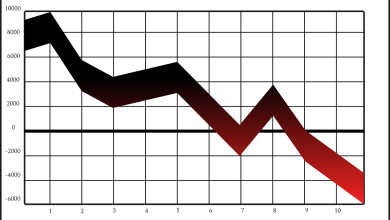

Noventiq previously said it was moving to a US listing as it claimed it was “undervalued” on the LSE.

The confirmed move is “expected to provide Noventiq with improved access to new sources of capital” and “accelerate M&A opportunities”, the firm said.