Worldwide PC shipments totaled 68.6 million units in the fourth quarter of 2018, a 4.3% decline from the fourth quarter of 2017, according to preliminary results by Gartner, Inc. For the year, 2018 PC shipments surpassed 259.4 million units, a 1.3 percent fall from 2017. Gartner analysts said there were signs for optimism in 2018, but the industry was impacted by two key trends.

“Just when demand in the PC market started seeing positive results, a shortage of CPUs (central processing units) created supply chain issues. After two quarters of growth in 2Q18 and 3Q18, PC shipments declined in the fourth quarter,” said Mikako Kitagawa, senior principal analyst at Gartner. “The impact from the CPU shortage affected vendors’ ability to fulfill demand created by business PC upgrades. We expect this demand will be pushed forward into 2019 if CPU availability improves.”

“Political and economic uncertainties in some countries dampened PC demand,” Ms. Kitagawa said. “There was even uncertainty in the U.S. — where the overall economy has been strong — among vulnerable buyer groups, such as small and midsize businesses (SMBs). Consumer demand remained weak in the holiday season. Holiday sales are no longer a major factor driving consumer demand for PCs.”

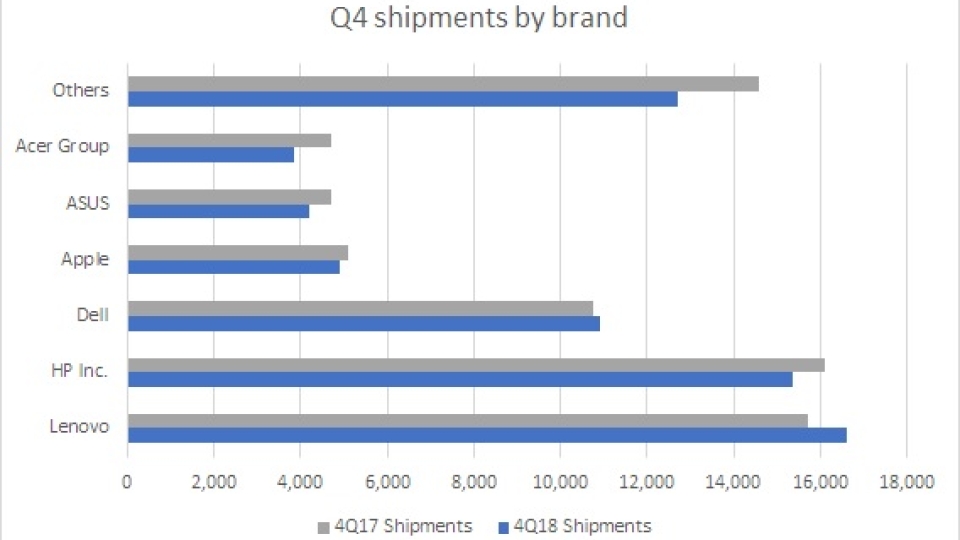

The top 3 vendors boosted their share of the global PC market as Lenovo, HP Inc. and Dell accounted for 63 percent of PC shipments in the fourth quarter of 2018, up from 59 percent in the fourth quarter of 2017.

Lenovo surpassed HP Inc. to move into the No. 1 position in the global PC market in the fourth quarter of 2018. A major factor for Lenovo’s share gain was credited to a joint venture with Fujitsu formed in May 2018. Lenovo also had a strong quarter in the US. The company has recorded three consecutive quarters of double-digit year-over-year shipment growth, despite the stagnant overall market.