Confirming this week's reports of a return to business for many IT sectors through channels, IDC says the second quarter of 2020 (2Q20) ended well for the traditional PC market, comprised of desktops, notebooks, and workstations, with global shipments growing 11.2% year over year reaching a total of 72.3 million units. As restrictions around the world tightened in the first few weeks of the quarter, demand for notebooks continued to grow to maintain continuity of business and schooling for many communities.

In EMEA Traditional PC shipments exceeded already optimistic expectations, posting strong double-digit growth in 2Q20. As lockdowns entered full swing, recovery in the supply chain meant that the unprecedented pent up demand for mobile form factors, needed to facilitate working and studying from home, was able to be satisfied.

Despite logistics issues early in the quarter, the cost and frequency of both air and sea freight inched closer to normal (i.e. pre-COVID levels). This, combined with PC production ramping up (and in some cases surpassing previous levels), meant that retailers and other distributors around the world had ample supply and were ready to fulfill the surge in demand.

"The strong demand driven by work-from-home as well as e-learning needs has surpassed previous expectations and has once again put the PC at the center of consumers' tech portfolio," said Jitesh Ubrani research manager for IDC's Mobile Device Trackers. "What remains to be seen is if this demand and high level of usage continues during a recession and into the post-COVID world since budgets are shrinking while schools and workplaces reopen."

"Early indicators suggest strong PC shipments for education, enterprise, and consumer, muted somewhat by frozen SMBs," said Linn Huang, research vice president, Devices and Displays at IDC. "With inventory still back ordered, this goodwill will continue into July. However, as we head deeper into a global recession, the goodwill sentiment will increasingly sour."

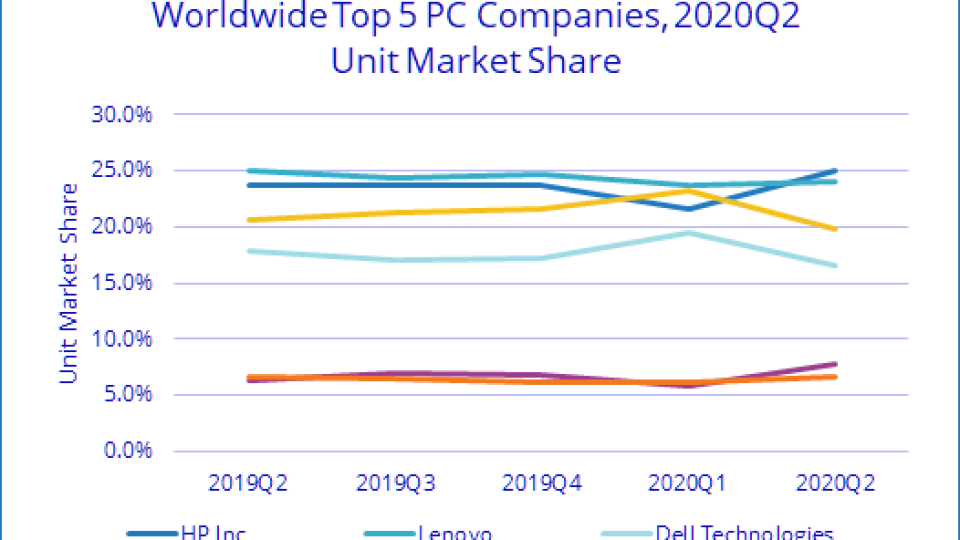

HP did particularly well, with a 17% jump in 2020 Q2 over the same quarter in 2018 to retake market leadership from Lenovo which grew 7%.