IDC's latest EMEA Server Tracker shows everyone else gaining from IBM's decline, especially Cisco. The EMEA server market saw strong growth in both revenues and units shipped in 2Q14 in comparison to the same quarter last year. Revenues increased 3.6% YoY, to $3.2bn.

IDC's latest EMEA Server Tracker shows everyone else gaining from IBM's decline, especially Cisco. The EMEA server market saw strong growth in both revenues and units shipped in 2Q14 in comparison to the same quarter last year. Revenues increased 3.6% YoY, to $3.2bn. IDC's latest EMEA Server Tracker shows everyone else gaining from IBM's decline, especially Cisco. The EMEA server market saw strong growth in both revenues and units shipped in 2Q14 in comparison to the same quarter last year. Revenues increased 3.6% YoY, to $3.2bn. This growth was also seen in shipments in the EMEA region, with the first positive YoY unit growth in the past 10 quarters — an increase of 2.5% for a total of just over 550,000 units.

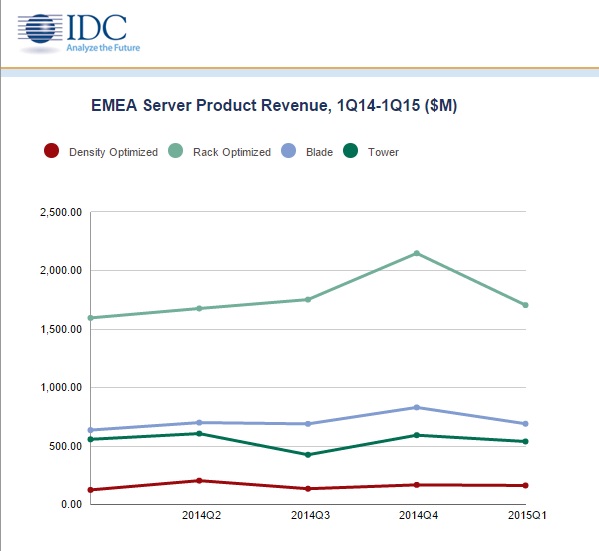

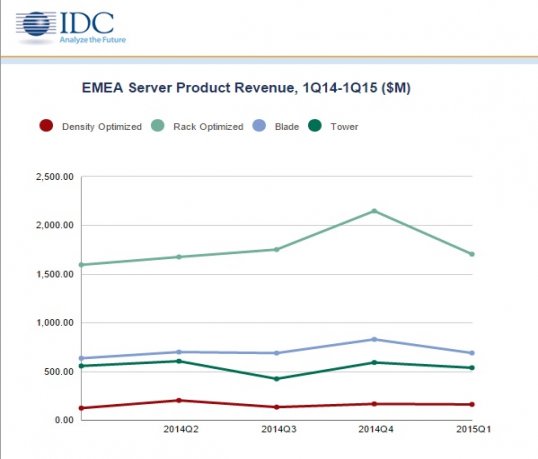

This growth in vendor revenue was mainly driven by a strong quarter on the x86 side, which reported its highest YoY growth figures for the last 11 quarters (+14%), and by larger vendors that saw increased traction in the blade and density optimized segments, where the top 5 vendors were responsible for the majority of the increase. Rack servers continued to expand on the growth seen last quarter to report 4.4% revenue growth on 2Q13, but they were overshadowed by the 49% growth in density optimized and the 21% growth in blade servers.

Western Europe has continued to improve on the positive growth seen in 1Q14, reporting 6% YoY revenue growth, up four percentage points on 1Q14 — the first positive growth in the past 10 quarters, to $2.4bn for the quarter. Units shipped into the region have also followed this trend and have grown on last quarter's results, with positive growth of 4.5% and more than 407,000 units — an increase of 17,000 units on 2Q13.

"Thirteen out of sixteen Western European markets showed spending growth in euro terms in 2Q14, as an enterprise spend and lifted almost all boats, with some help from the secular trends of Big Data and cloud, which will combine for around 17% of server spending in 2014. This is a good sign, especially considering the upcoming x86 CPU upgrades, but IDC remains cautious for 2H14 in light of recent macroeconomic changes that could dampen growth," said Giorgio Nebuloni, research manager, Enterprise Server Group, IDC EMEA.

Holding 79% of the market in revenue terms (an increase of 7 percentage points on last year), x86 architecture accounts for $1.9 billion of the Western European market — growth that has been driven by increased traction from both AMD- and Intel-based machines, which have seen double-digit YoY revenue growth.

Linux and Windows operating systems have rallied in terms of revenue, and have grown both market share and in absolute terms compared with the 2Q13 figures, with 19% YoY growth and a 6% revenue share increase for Windows. Linux systems have followed this trend, with a 2 point share increase and 15% YoY growth.

"The Western European market has shown increased traction in blades and density optimized, with sizable growth in shipments and revenue," said Eckhardt Fischer, research analyst, IDC EMEA Enterprise Server Group. "Density optimized has shown the largest growth, reporting 35.9% and 25.7% YoY revenue and shipment growth respectively in the x86 market, a trend that has been partly driven by the increased adoption of Big Data and business analytics in the enterprise market."

"A significant chunk of demand for density optimized but also for some rack servers is coming from major cloud service providers and hosters that are continuing to expand their datacentres in Western Europe and are increasingly building out presence in key markets, including the UK, Germany, and France," said Andreas Olah, research analyst, IDC EMEA Enterprise Server Group. "While Asian original design manufacturers [ODMs] are capturing larger shares in these volume markets, there is also a trend toward higher-end models particularly on the blade side with features including high-availability, energy efficiency, and in-memory capabilities."

Central and Eastern Europe, the Middle East, and Africa (CEMA) server revenues continued to shrink in the second quarter of 2014, with a YoY decline of 3.7% to $719.8m, mainly due to weak sales of non-x86 systems, which were down 31.6% YoY, while x86 servers recorded a 3.9% YoY increase in revenue as clients continued to migrate to the x86 environment.

The Central and Eastern Europe (CEE) subregion was down 10.0% to $349.95 million as geopolitical risks surrounding the Russia/Ukraine crisis weighed negatively on business sentiment in the region.

Rack servers, the largest contributor to the EMEA market, saw an 8.7 percentage point improvement on their 2Q13 growth rate, reporting 4.4% in 2Q14, for a revenue of $1.7 billion. Tower servers have continued to contract, with a 19.4% decrease in revenue, reaching $604m. Blade servers, however, have continued to grow and now represent 6.2% revenue share in EMEA, with a total contribution of $696m.