Research by Regent into sector finds volatility in European TMT IPOs

Research by Regent into sector finds volatility in European TMT IPOs Any effects of the UK’s decision to leave the European Union have yet to show in the tech M&A statistics, says M&A consultant Regent. European TMT merger and acquisition deal flow remained strong in Q3 2016 with 888 deals announced, a decrease of 1% over the previous quarter. The total value of deals in Q3 rose to $77bn from $60bn in Q2, boosted by SoftBank’s $32bn acquisition of ARM. The median deal size dropped from $18m in Q2 to $13m in Q3 indicating a greater number of smaller deals.

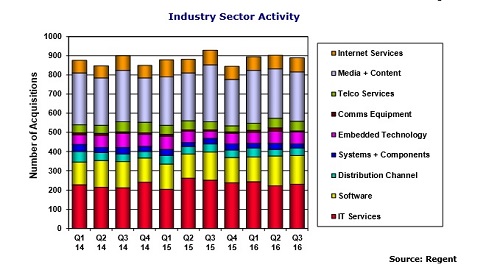

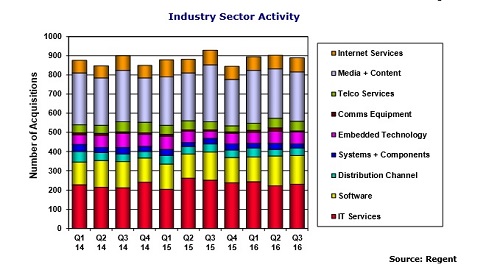

The number of acquisitions in the software and IT services sectors has been very consistent over the last three quarters, resulting in the combined sector accounting for 43% of European TMT deals with an increase of 3% in IT services deals offsetting a 3% decrease in software deals. The Content and Media sector was also stable with just 2 more deals (1%) in Q3, accounting for 29% of all deals in the quarter. The telecoms sector saw a 23% decrease in deals in Q3 mostly due to a 67% drop in the number of acquisitions of communications equipment companies. In Q3, the telecoms sector accounted for 6% of all TMT deals.

There was continuing volatility in the number of European TMT companies making an IPO which dropped to 10 in the third quarter from 26 in Q2.

Financial buyers (private equity) continued to be very acquisitive in Q3 accounting for 18% of the announced deals, unchanged from the previous quarter. Altogether private company buyers, including financial buyers, accounted for 68% of the deals. It should be noted that many of the buyers identified as private companies are backed by private equity.

The UK remains the dominant country in terms of buy-side activity and its share of the deals increased from 22% in Q2 to 28% in Q3. North American buyers accounted for 12% of the deals, down from 13% in Q2. Scandinavian buyers accounted for 11% of the deals, most of which are within the Nordic region. Buyers from The Rest of the World, primarily China and Japan, accounted for 6% of the deals in Q3 which was an increase of 21% over the previous quarter.