Economic issues such as high inflation and ongoing resource constraints where highlighted as key market disruptors impacting MSPs surveyed at last month’s Growth Forum that welcomed a quorum of the UK’s fastest-growing IT and communication service providers at the Grove Hotel, on February 2nd – 27th.

As 63% of Growth Forum attendees stated that strengthening customer relationships was the focus of their strategic efforts when planning for growth, panelists across the day’s insight sessions elevated agile frameworks and clear communication as critical to building deeper bonds during the scaling process.

The emphasis on turning disruption into a catalyst for growth was the subject of the event’s third session, which brought insight from Jamie Emmitt, EMEA Sales Manager, Huntress, Arsalan Eizadirad, Senior Manager, Global MSP Strategy, Lenovo, Kyle Torres, Channel Account Executive, Sophos and Venu Gudimetla, Head of Marketing Development at Tata Consultancy Services.

They collectively discussed the importance of agility in an ever-evolving industry. Gudimetla stated: “In this industry disruptions are regular and continuous so if you don’t have an engine to adapt you will be left behind. The rate of disruption is also getting much steeper and is coming at MSPs from all angles.”

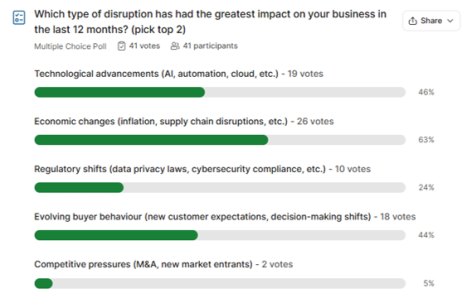

In support of this, delegates voting was tight when choosing the two types of disruption that had the greatest impact on their businesses in the last 12 months. Economic changes were highlighted by 63% of respondents, with technological advancements and evolving buyer behaviour chosen by 46% and 44% respectively. This reflects a need to adapt to disruption at both macro and micro level.

Panelists highlight how these disruptions have the potential to affect customer relationships. Torres noted that against economic changes, buyers are becoming more discerning. “With inflationary issues customers are wondering if they can afford to spend on tech,” he said. “Also, they are taking a more considered look at their MSP partner as part of their supply chain.” This is where relationships that transcend the transactional become particularly important.

There is interplay here with the rate of technological advancement, says Emmitt. “A fear of investment is exacerbated when you are selling to replace a solution that you put in place two or three years ago,” he noted, with a particular focus on cybersecurity. “You must find a way to communicate what has changed and why the client needs to continually invest to stay address disruptions. Torres acknowledged that these are tough conversations to have and advised: “Winners will be the ones that can articulate innovation to their customers and activate their own disruptive thinking. Being upfront is the best method for this.”

Here Torres noted how Sophos is turning economic disruption into a competitive advantage. He highlighted that the above trends, alongside tighter regulatory environments, have shifted the sales process for cybersecurity customers that now demand much more information and transparency. “This has led to far more deals for us because we get closer to customers and build that trust from the beginning,” he said. “We can also explain innovative GTM strategies upfront that will take off some of that technology investment pressure.”

Achieving agility

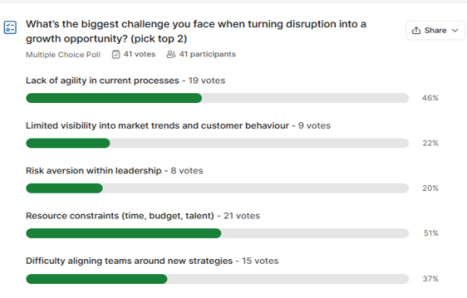

Panelists agree that agility is a key skill for MSPs in an ever-evolving landscape. Emmitt added: “Innovation isn’t just good to have in our industry, but it is essential.” However, lack of agility in current processes was flagged by nearly 50% of delegates as one of their top two challenges when generating opportunities from disruption, with only resource constraints ranking higher.

Here panelists suggested frameworks that build in agility. For example, Huntress ensures that in each weekly team meeting, an employee is tasked with bringing a short report on an emerging technology or world trend that they have come across through their role or across media. “This alternates between departments,” he added. “Therefore, we get an oversight of what is developing outside of our own spheres that we tend to get drawn into and get a holistic view of the changing channel landscape.”

Gudimetla also suggests that businesses ring fence a set of workers as dreamcatchers that look to opportunities in the next three years. He added that this isn’t something limited to larger organisations and suggests that small MSPs can keep aside just 3% of their revenues just for innovation. He said: “Make sure your business always keeps an eye on the future so you can be prepared for the next big disruptor.”

Eizadirad echoed that small businesses shouldn’t be put off from innovation due to the costs of adopting new technology, highlighting AI as an example. He said: “My suggestion to MSPs is that you can start somewhere small with AI and grow with it. This is where you should assess your vendor ecosystem and see who has a solution that can get you started.”

Disruption in the next 12 months

Discussing which disruptions would emerge to drive channel transformation in the next year, panelists agreed that compliance was set to become top-of-mind, despite it only being cited as a big impact point for 25% of delegates. Emmitt said: “Compliance is an area that is going to become more intrusive to your customer’s everyday lives. It will act as a point of confusion, and they will rely on MSP partners more for guidance. This is a real opportunity to help them and strengthen their relationships.

Gudimetla and Torres both highlight AI as an area where compliance is going to create a significant disruption in the future. Gudimetla believes there will be a framework implemented soon to address ethics and responsibility. Torres pointed out: “The EU already implemented its own AI governance last year and it does include fines. If we follow suit then everyone who's using AI in their business will have to reconsider.” Gudimetla also points towards the trend of increased sovereignty caused by geo-political disruptions.