Eastern European software giant Luxoft is doing more business in APAC and outside its main base as it tries to reduce its dependence on big European clients. Its Q2 results showed revenue of $228.4 million, up 0.2% year-over-year and up 7.3% sequentially, a fall in income to $14.4m, compared to $18.4m in the year-ago.

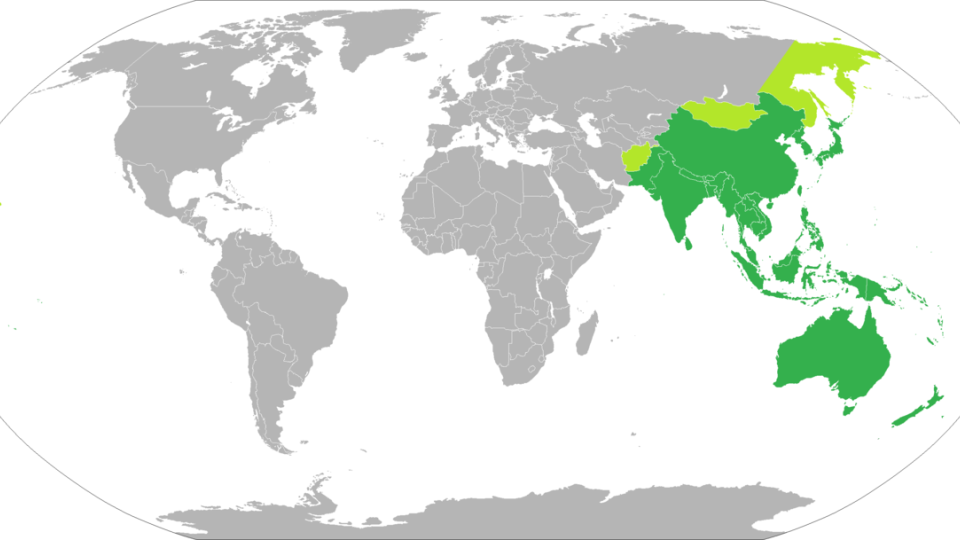

Revenue generated in APAC and Europe grew 64.7% and 16.8% year over year, respectively.

Expanding global presence and growth outside of Financial Services is meaningfully reducing client concentration, it says. Revenue by line of business was 54.9% Financial Services, 23.1% Digital Enterprise and 22.0% Automotive.

"Our second quarter results demonstrate continued execution of our strategic priorities and transformational initiatives," said Dmitry Loschinin, Luxoft’s CEO and President. "We continue to diversify our revenue and re-align our focus and resources to the highest growth opportunities. Growth in Financial Services remains healthy, despite challenges in the Investment Banking sector, while our leading Automotive solutions continue to drive strong customer demand. We remain sharply focused on enhancing our Digital solutions in order to advance our competitive position and meet the evolving needs of our clients."

"Looking ahead, we remain focused on advancing our transformation and building a stronger and more diversified company. While we expect some headwinds during the second half of the year, we are confident that further execution of our strategy will strengthen our long-term growth profile and position us to deliver increasing shareholder returns."

Top Two accounts amounted to 30.2% of revenue, representing a 5.2 percentage-point decrease over the prior year. Top Five accounts amounted to 43.4% of revenue, an annual 3.3 percentage-point decrease, and Top Ten accounts amounted to 54.3% of revenue, a 3.3 percentage point decrease.