Cloud data analytics vendor Sumo Logic has announced an initial public offering (IPO) to help fund growth, including extending its channel across Europe. The California-based vendor aims to raise up to $100m in a Nasdaq public offering. The company primarily sells subscriptions through its direct sales organisation in the US, and relies on channel partners to sell into international markets where it doesn't have a direct sales operation.

The company currently has over 150 international channel partners, with existing foreign sales offices in London, Sydney and Tokyo. The company generated 17% of its revenue from outside the US in the quarter ended 30 April. International expansion represents a “significant growth opportunity”, it said.

Last year, Sumo expanded its EMEA operations with new leadership and a wider partner ecosystem, opening new offices in Holborn, central London. This May, Westcon sealed a pan-European distribution agreement with Sumo. Key EMEA markets include the UK, Germany and the Nordics with business verticals including media, finance and technology.

Current customers include the BBC, Channel 4, Magine, Paf, Sporting Group and Vaimo. It has two research and development centres in Poland and India to enhance and extend the breadth and depth of its machine data analytics platform.

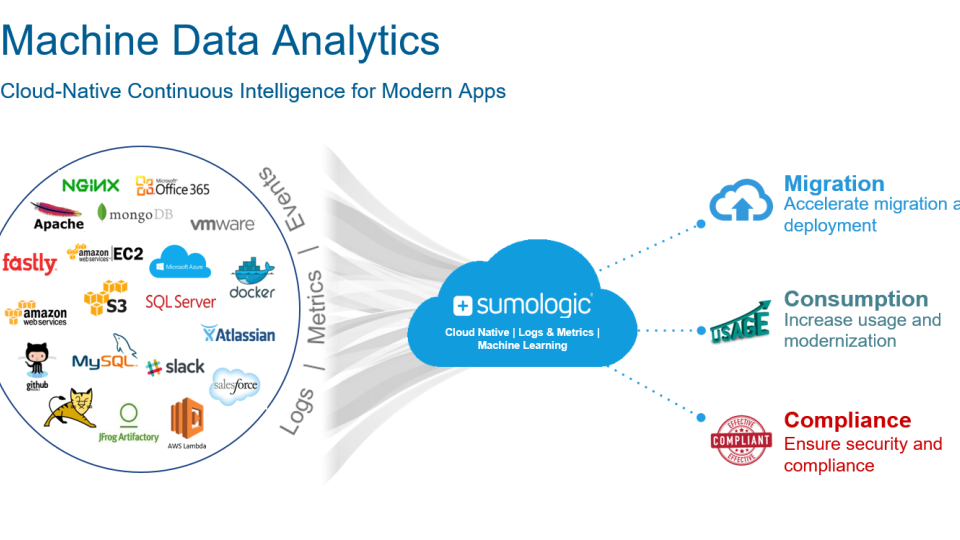

“As part of our go-to-market strategy, we have developed a strong ecosystem of partners, including independent software vendors, distributors, resellers, managed service providers and managed security service providers to help us expand in existing markets, as well as enter and grow in new markets,” said Sumo Logic in its IPO document.

The money raised will also be used for potential targeted acquisitions and the company plans to be listed under the ticker symbol SUMO. Sumo's sales jumped to $155.1m in its most recent fiscal year, that ended 31 January - up 49.6% annually. But growth has come at a cost, with annual net losses surging to $92.1m, which was a 92.8% increase on the net loss of $47.8m for fiscal 2019.

In its IPO document, Sumo said: “We expect our operating expenses to increase significantly over the next several years, as we continue to hire additional personnel, particularly in sales and marketing and research and development and expand our operations and infrastructure.

“If we fail to increase our revenue to sufficiently offset the increases in our operating expenses, we will not be able to achieve or maintain profitability in the future,” it warned.