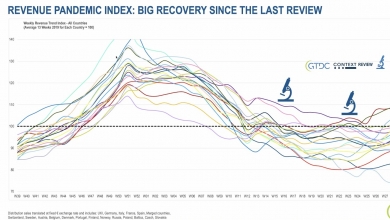

The IT channel has had a strong start to the year with growth in the first half of 5.1% yr/yr; resellers in most countries are more optimistic about the coming 12 months than they were a year ago, says CONTEXT, the market researcher with access to distributors’ sales numbers.

The number of resellers has also stabilised: after a decline of 3% noted last year, the YoY drop this report was a near negligible 0.3%. It’s also a mature market, with nearly half (49%) of those companies surveyed being over 15-years-old and just 14% less than five years-old.

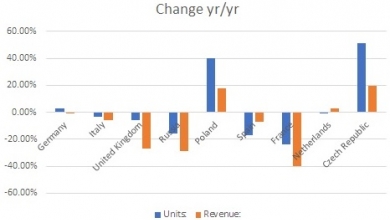

CONTEXT’s ChannelWatch 2018 report found that all countries are in growth this year following a slight decline in H2 2017 when year-on-year (YoY) growth was 4.6%. Some markets have expanded at a rapid double-digit YoY growth rate in 2018 including Russia (21.7%) and Portugal (10.2%).

It is compiled from interviews with a representative sample of over 7,000 resellers to provide key insight into market trends and channel priorities across 14 countries: Australia/New Zealand, Baltics, Czech Republic, France, Germany, Italy, Poland, Portugal, Russia, Slovakia, Spain, Turkey, and the UK.

The majority (63%) are optimistic about business in the next 12 months, with just 10% believing they’ll be worse off and less than a third believing things will stay the same. Only Germany, Poland, Slovakia and the UK are less positive about the next 12 months than when they were polled in 2017, with the latter’s pessimism likely to be linked to Brexit uncertainty.

Portugal, Spain, Australia/New Zealand and Baltics were the most optimistic countries.

Business services was named by the largest number of resellers (14%) as accounting for over a quarter of sales and the vertical they expect most growth in this year. It’s number one in six out of 13 countries, although retail tops the list in Eastern Europe (Baltics, Poland, and Slovakia) and Turkey while manufacturing is the pre-eminent vertical in Germany, the UK and Russia.

“It’s reassuring to see the IT channel as a whole in pretty good health as we head into the second half of 2018,” said Adam Simon, Global Managing Director. “However, despite the optimism in the market for the coming 12 months, challenges persist: not least in areas like financing, staff recruitment and retention, GDPR compliance and the threat to distribution posed by etailers.”

Whereas in 2017 half of respondents said they had “no” financing concerns, the figure dropped to 27% this year, with the UK hit particularly hard by Brexit-related exchange rate fluctuations and borrowing concerns. And skills are in demand: some 60% of respondents globally claimed that finding people with the right qualifications remains a challenge, especially in Russia and Turkey.

At the time of running the survey, half of European respondents claimed they were ready for the GDPR while 29% were not, with Germany, the UK and Portugal seemingly the best prepared.