Distribution prepares for time of great change, role is evolving; GTDC Award winners

Distribution prepares for time of great change, role is evolving; GTDC Award winners The annual EMEA GTDC event brought together the leaders of European distribution and found them in a bullish mood, although acknowledging the scale of investment in transformation that they are needing to undertake. On the plus side is the recognition that the last ten years have seen its members move from €70bn to €130bn in revenues.

Any arguments over the role of distribution as opposed to vendors selling directly to resellers dissipated long ago, GTDC CEO Tim Curran (below) says. The distributors are faced with many new requests to take product lines, and while the US remains a strong source of these, there are additional new entrants from the Far East. He told the meeting that there have been 600+ new vendors in distribution in US and EMEA in the last two years. “Europe's distributors are resilient, diversified and innovating....and the IT industry's partners of choice,” he says.

Looking at the sales numbers, last year was a good one for the channels, but 2016 is proving tougher. There has been a slow start to distributors' business in EMEA in first half 2016 after strong second half in 2015, but the reasons are not hard to find with UK confidence dented by the EU debate, and economic problems in France. Germany, is powering ahead, however, and the SMB sector seems to be building strongly in the UK and Germany.

But distribution knows it needs to invest in newer technologies: cloud, IoT, mobile and big data. And Tim Curran warned that some vendors' senior executives may not all be seeing how the channel and distributors can play a role in cloud, although those downstream at the sharp end get it. Many distributors seem to be moving quickly to present new cloud marketplaces, providing resellers with aggregated services and single billing, although there remain some issues – cloud delivery opens up adjacent geographical markets and local vendor agreements may be rendered pointless by cloud. This is an issue yet to be concluded, but the explosion of coverage will certainly impact channels as ALSO's deal with Logicom indicates.

Some leading distributors are looking very closely at IoT, which promises big scale, new verticals and many new customers. Some 60% of IoT vendors are in discussion with distribution, with 12% already engaged, says GTDC research. “It will bring new partner types into channel, all needing support,” it says. While cloud growth is already strong this year, some are saying privately that IoT could be worth more and be more profitable.

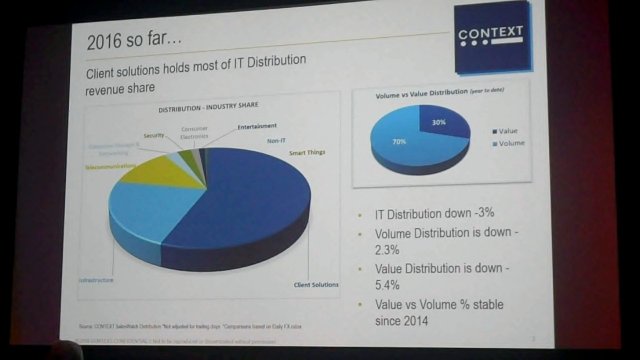

The other areas may be more of an issue, the channel lacks skills to take full advantage of mobile/comms; distribution can help, just as it now has to educate channels on security; channels are short on security skills, the GTDC says. Security remains one of the bright spots in 2016 – in analysis from researcher CONTEXT, which has access to GTDC members sales figures, sales through distribution are down 3% year on year so far in 2016, with Volume down 2.3%, Value down 5.4%. Canalys, on the other hand says that although distribution is down, reseller sales in Q1 are actually up as the move to annuity sales takes hold. It advises that in future, both vendors and, distribution should segment channels more: it is not one market.

The vendors have an interest in this: they say that the numbers of core volume active partners in Europe is declining, distribution finds this less so as they are very active in adding new partners, Canalys says; but there are effects from consolidation, both in channels and into big etailers, and the rise of the global partner is eating into local players. Partners are specialising, selling cloud, services in verticals, while aligning businesses for the future, and collaborating more.

Cloud backup and protection are the fastest growing areas in B2B distribution - up 155% yr/yr says CONTEXT. Enterprise servers remain the biggest part of Value distribution followed by Networking; looking forward, the interesting business areas will be Security, virtualisation, mobility, cloud, storage, SaaS, disaster recovery which over 70% of resellers in a CONTEXT survey all NAMES as b2b growth areas.

- The GTDC rewarded the region's fastest-growing IT vendors at its Rising Star Awards. The winners span a full cross-section of technologies, from the cloud and mobile computing to data center, networking, security, Big Data and other advancing market segments. GTDC EMEA Rising Star award winners are chosen based on CONTEXT SalesWatch Distribution database sales growth tracking from April 2015 to March 2016:

HARDWARE

€25M - 100M

LaCie (Seagate) Gold

Wiko Silver

Aruba Networks Bronze

€100m - €500m

F5 Gold

TP-LINK Silver

AVM Bronze

€500m - €1bn

Huawei Gold

Microsoft Silver

Lexmark Bronze

€1bn+

Dell Gold

Apple Silver

Lenovo Bronze

SOFTWARE

Veeam Gold

Autodesk Silver

Oracle Bronze