Service providers in the vehicle telematics industry are being encouraged to increase their offerings to fleet managers, to address the demand for new technologies.

IT Europa attended this week’s Telematics Vilnius 2023 event, and previously reported the growth that GPS tracking and vehicle management software provider Wialon is experiencing through its global channel.

The event was organised by Wialon mother company Gurtam. Gurtam CEO Aliaksei Shchurko told delegates that the money being charged by the truck manufacturers for basic connectivity and data services was “too much”, at between $10 and $20 per month, and sometimes more.

Wialon charges its partners around $3 a month for connectivity, who then pass on that cost with a profit on top to fleet managers, with other services charged for separately. But while it is possible for them to undercut truck companies like Scania, Volvo and Mercedes for basic connectivity, Wialon maintains too many of them are not moving fast enough to offer newer and evolving services.

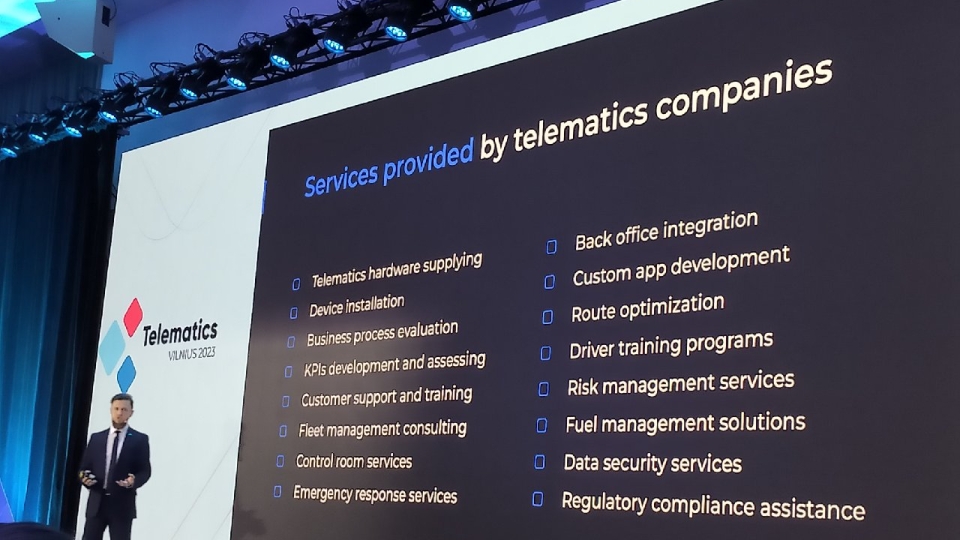

Aliaksandr Kuushynau (pictured), head of Wialon, told the partner conference that such services included business process evaluation, KPI development and assessing, customer support and training, control room services, back office integration, custom app development, risk management services, fuel management, data security, and compliance.

He said Wialon didn’t want to provide these services, even though it could. It wanted to concentrate on building up its global connectivity installed base, and provide free tools to partners to help them develop the service offerings they needed to boost sales to fleet managers.

On the performance of partners in growing the Wialon installed base, it is quite good, he said. In the last 12 months, 47% of them had grown the number of connections by 10%. “But partners need to provide a greater variety of services to increase business,” he said.

He expects the number of global connections to increase from 3.8m in 2023 to 4m next year, which he estimates would give Wialon a 4% share of the global fleet connectivity market. “Is this big,” he asked the audience. “Yes”, he said, when put into context of global leading brands in other technology markets.

Kuushynau said Spotify, Red Hat, Dropbox and Slack, among others, currently owned 4% of their respective markets.

He added: “Safety, compliance and efficiency are the three pillars that organisations are concentrating on, and partners need to address them. It’s not about platforms and technology either when you speak to fleet managers, it’s about addressing their real needs.

“It’s important for partners to establish themselves as thought leaders, and show the way forward.”