Alongside the Chancellor of the Exchequer’s Autumn Statement this week, the UK government published its Future of Payments Review (FoPR), which will potentially affect how the channel, alongside the rest of industry, handles its business transactions going forward.

The FoPR considered whether the UK’s current payments infrastructure supported customers, and how it could be improved to increase competitiveness.

The FoPR recommended the government should develop a National Payments Vision and Strategy, covering resilience and safety, competition and customer experience, international integration, regulation, fraud, interoperability, digital IDs, and innovation.

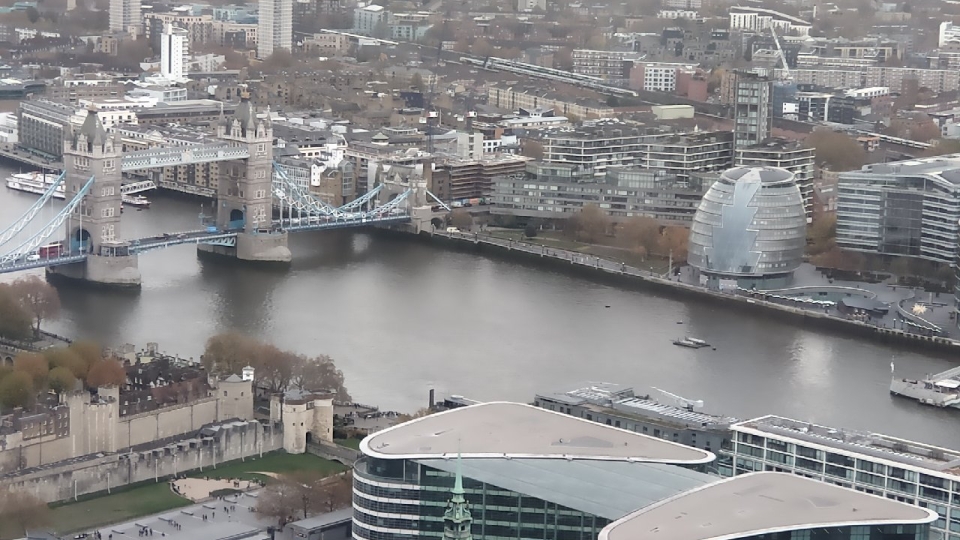

It just so happens, that while the government was considering changes, IT Europa was attending a payments industry conference at Landing Forty Two in the Leadenhall Building, in the heart of the City of London. We were able to glean the progress that is already being made in changing the payments infrastructure for the better, helped by channel players.

The conference was organised by payment services player Bottomline, and included an informative panel led by UK regulators and industry bodies, including UK Finance.

Like other service providers to the financial services market, Bottomline is busy making its offerings available in go-to-market initiatives with other providers across EMEA, integrating them with the technologies offered by cyber security vendors, and making them available through IT services marketplaces. The company says it is working to make sure managed service providers can adopt its technology too, for the benefit of their own end customers.

Payment services are changing in response to the wider adoption of Open Banking, the entry of new FinTechs, and the acceptance of the legacy banks and insurance companies that the market has to evolve to match customer expectations, and to satisfy ever more proactive industry regulators. This is all driving an ever more potentially lucrative services market for those that can jump on board with ecosystem partners.

Richard Ransom, manager, solution consultants: corporates for EMEA and APAC, at Bottomline, told IT Europa: “From our research, over half of the industry hasn’t even heard of the New Payments Architecture (NPA) that providers, regulators and others are already moving towards. Often banks think more about consumer payment initiatives rather than corporate ones.

“But it’s corporates that will have to push initiatives such as the NPA through, so this is why we decided to hold this event.”

While individual banks weren’t invited to the event, they were represented by their industry body UK Finance, and corporate users of financial services systems were in attendance.

Ransom said service providers should be making it easier for corporates to adopt more automated payment processing through Open Banking schemes, to help them move away from slower and less reliable Excel spreadsheet systems, which are still widely used, and more expensive credit card payments.

Automatic Variable Recurring Payments (VRPs) using Open Banking networks are one alternative payment solution being developed as part of the New Payments Architecture covered by the conference. The NPA is also set to replace the existing BACS payment infrastructure and Faster Payments within the next five years, the conference heard.

On the aforementioned industry panel, Nick Davey, payment specialist at the Payment Systems Regulator, said: “Changes to payment messages [in the NPA] will deliver more information to those involved in payments, and will help in preventing mistakes and fraud, but it is going to be painful getting there.”

Alex Harris, payments and identity programme director at Capita, explained: “The banks are not ready very often, as their systems are harder to change. For instance, often their global systems are different in every country they operate in.”

“Banks are going to have to deliver the changes to payment messages [related to ISO20022 in the NPA], and you can have variant messages, but you have to register them to support consistency in the system,” added the PSR’s Davey. “Will BACS be replaced in five years?, I’m not sure about that. But Faster Payments will, and a new name will be found for it. Direct Debits will probably not be replaced though. The Bank of England will have a say on such matters.”

Phillip Mind, director for digital technology and innovation at UK Finance, reminded the audience how quickly new payments systems can be taken up by users. He asked how many of the audience now used Apple Pay, and over half did on a show of hands. Only one did two years ago.

Mind said Variable Recurring Payments may well advance quickly as an alternative to Direct Debits, but that the banks would have to be brought fully on board to make it happen.

Davey said VRPs may be beneficial to certain customers, but that he didn’t think they would fully replace DDs. If VRPs are going to take off, they will need to provide greater protection and control, like that provided by DDs, he said..

Capita’s Harris chipped in: “Regarding VRPs, many of us rely on SAP platforms, for instance, and we all know how difficult it is to make changes, everything moves incredibly slowly.”

Davey replied: “A long time ago I was involved in implementing a SAP system at the Bank of England, and that was horrendous. But, we know these changes are coming along, and you have to ask your system providers the correct questions.

“And if the changes are mandated by the operator of the system, it should be easier to push things forward.”

The UK government has asked for change in the payments regime, and whatever obstacles are in the road, it sounds like the payments industry ecosystem is at least moving forward.