Demand for managed services by customers continues to rise, and since this business is all about scale, so consolidation and acquisition is racing ahead.

The Managed Services Summit in London this week heard from IT Lab CEO Peter Sweetbaum, who has been involved in thirteen acquisitions either a buyer or seller, the most recent being Mirus IT in August.

At the summit, IT Europa spoke to Jonathan Simnett, director of tech M&A experts Hampleton Partners about the acquisition picture in the services sector.

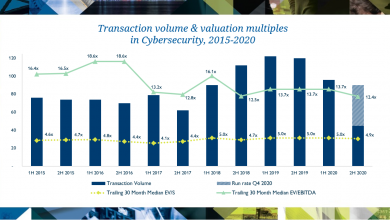

His company's latest report, out this week, reveals a continuing trend as the value of IT outsourced services companies (measured as EV/EBITDA) has risen from 9.1x to over 10x in the first half of the year as compared with the first half of 2018. At the same time, integration services business value seems to have fallen slightly from 9.4x to 9.0x.

He said: “As companies in the IT Services sector experience pressure to reduce capital expenditure, they have remained in strong demand, as enterprises aim to modernise by using technology to increase operational efficiencies. Demand for companies offering services such as cloud, communications, system integration tools and cybersecurity has led to a rise in M&A targeting outsourced IT services.”

There are some strategic factors driving acquisition as well, he says. One is that large companies are pivoting – changing by getting more capability, taking out their competition.

Also, private equity firms have started to move in to capitalize on the pace of growth in the sector and this is driving up valuations. And of course, the big tech firms are consolidating, strengthening their expertise and they're taking competition out of the marketplace. “If you look at who's buying, the top name continues to be Accenture made 32 purchases over the last year without really showing it to anybody,” he says.

“What we are seeing is the valuations, particularly in hosting, has started to move up in the last six months. It's essentially because the clients want to move as quickly as they can because they're under severe competition. What they're looking for is to make sure they've got enough people and they're usually doing that by outsourcing. They need to make sure they're up to date with the latest technologies. You see a lot of interest in issues such as AI. And we're also just seeing that the constant need to reduce costs.”

And of course, there's a real shortage of good people in this market. So he suspects acquisitions are being driven by a need to gather resources.

Smaller businesses are either acquiring or being acquired. “The issue [for them] is can they grow quickly enough to get big enough clients to really survive? Otherwise they will get killed by big players that can come in, can command more resources and sell into the company and can offer better deals,” he thinks.

“We're seeing large technology players consolidating their business, but we're also seeing new players moving into the marketplace and introducing competition. So the second highest acquirer of businesses in the sector over the last 30 months has been Dentsu Aegis Network.

For those people who aren't familiar with this business, they are essentially an advertising agency. So they've become a systems integrator and a provider of technology services, he says.

And then hardware companies are turning into services companies. “So if you're in the orthodox systems integration or the hosting business, you should thinking very, very carefully about what it is that your clients need to survive and thrive in future. If you're doing the same old, same old and just doing more of it, you're going to be in long term decline. Looking for expertise in things like AI, big data analytics which not just buzzwords. These are the areas which are being invested in.”

The report, available here looks into the sectors Integration Services, Tech Services & Support and IT Outsourced Services and includes:

Trends and analysis of deal activity

Deal geography

Top acquirers

Valuation metrics

Managed Services North - hear Jonathan Simnett in person when he presents at the Manchester event on October 30th register now!