Jonathan Simnett, director of tech M&A experts Hampleton, told the Managed Services Summit North that activity was high currently and he did not expect this to change. One of the driving forces is the rate of innovation and speed of change in IT, which was leading larger companies to acquire rather than develop their own ideas.

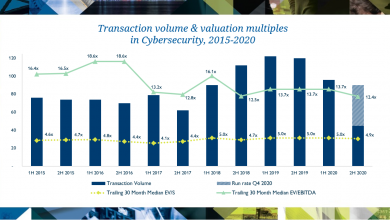

M&A activity is linked to the level of the NASDAQ stock exchange. “At the moment. Looking at the chart, people are asking if there will be another dot.com bust. My view is no, as this consisted of a lot of money going into unconnected companies, so there was no way for the companies to make any money.”

“And on AI – it is really the third coming of AI; only now do we have pervasive connectivity, linked sensors, huge amounts of cheap processing power and massively available data sets. Before, those conditions weren’t met, so that is why it was a false dawn.”

In the year to date, the market is steady, showing high volumes of deals, but the value may be down. have seen some peculiarities this year in that there appears to be s bifurcation of deals – a small number of small deals and a small number of very big deals, hence the value is up, he says.

"We are still seeing the high deal activity because M&A is part of the normal economic cycle, but the speed of the IT cycle is going faster. We see rapid market consolidation – and if your market is consolidating you can either be the biggest player in it, or be niche, or watch out – it may be time to sell.”

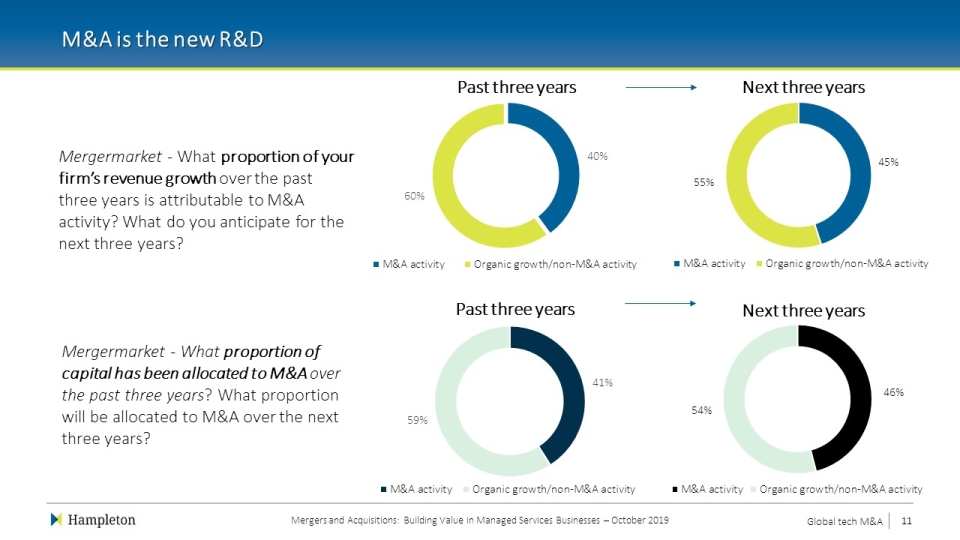

Bigger companies have a limited ability to innovate and have to buy it from other companies. "The market is undoubtedly being driven by the availability of cash and we are seeing the entrance of non-IT companies into the IT market buying up swathes of businesses. The good news for those of you thinking of selling is that the both the amount of growth IT companies expect to get from M&A, and the resources they devote to M&A is going to increase over the next three years."

The buyers of IT services are currently looking for skills rather than business structure. "The acquiring companies slip into two sorts – the first are those who are consolidators and pivoters, building out their capabilities; examples are Accenture and Capgemini. They just want to get more services they can sell to their existing customers. There are other companies like Konica Minolta and dentsu AEGIS who are fundamentally changing their business models and are acquiring to enable it to happen."

There are lots of multiple acquirers and activity in generic IT services, but if you are a specialist in a marketplace this can massively affect the valuation; autotech is very strong currently, he says, because of the paradigm changes, he says. “There are companies out there buying up IT services business like crazy and paying over the odds, and this will go up again in the next six months.”

Digital marketing is also attracting interest, but sellers need to have IP, not be generic. Ecommerce is high with new lines and new services. And enterprise software is really hot currently as companies try to build big suites of offerings, and are competing, he told the audience.