SaaS-based data analysis can be another tool in the box for cyber-security

When your business is all about watching data on behalf of others, it does not take much to be drawn into the cyber-security fold. Now called security intelligence, Silobreaker is pushing its SaaS-based services to resellers with a new channel programme.

The targets will be resellers working with some of the larger names, since it is those customers who may already be talking about watching the world for trends, news (often about their brands), or trends in cyber-attacks.

The key to understanding what Silobreaker does it that most firms concentrate on the internal data-usually in a structured form that can be easily diced and sliced. The problem is that the challenge often comes from the real world outside, and the data is often a mess.

“We try to do the heavy lifting,” says CEO Kristofer Mansson. “Especially in the era of fake news – we find people have preferred and trusted sources, but sometimes a 'use case' is to understand what less- trusted sources have. We can support this, but we can’t replace the human analysis on source value. If companies find their company data or assets out there on the web, they have no choice but to investigate it. We try to provide the tools to assess value, but we also want to view trends in the aggregate.”

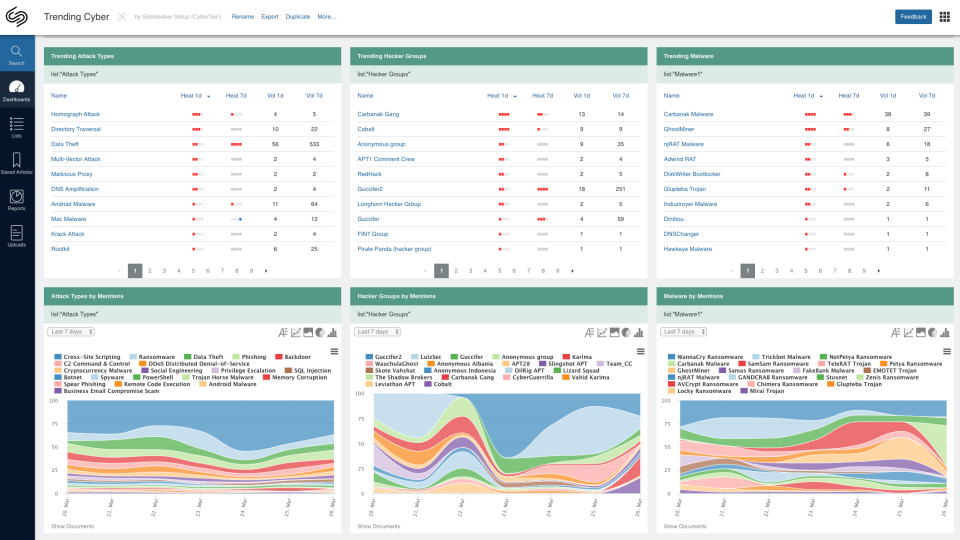

“We do search indexing and then abstract to find things in the data – a person, an IP address, a vulnerability identifier. We then also look at the relationships in what we have found – not telling the system about relationships, but letting the data analysis find them.”

It becomes a dynamic image and does then not relay on an analyst, he says, so it is very quick; “Yes there is noise, but we have found that the customers like the timeliness. It means any analyst can focus on the findings, not the data.”

Silobreaker has been working with a select group of partners to develop a channel programme in the region and currently has a customer renewal rate of 90%, he says. Now it is looking for more channels. “What we want in the first year is to have ten to twenty partners in the US and UK, and we are looking for the right partners, since we are keen that we have the resources to manage them. We are using the channel to give coverage.”

In three years this will rise to 50-100, he says, and covering the market globally rather than the US and UK. It is currently aimed at the English-speaking world, but the data is coming through in fourteen languages and this sits well with the channel program which aims to find local players in the regions.

The sales process has to be somewhat vendor-led, he says, based on experience and working with resellers in the past, with help and support leading to a deal. It takes a while and is based on learning by doing. “Our challenge in enabling customers when it is not shrink-wrapped. The reaction from channels is that they are keen – they are looking for components of a cybersecurity portfolio. Resellers like the SaaS delivery approach and like the annual revenues and cross-selling since it can link to other products such as data providers.”

He finds that the demo is the catalyst to move the sale discussion along but it does not necessarily have to be based around customers' internal data. “We may be able to bring them data they have not seen before on their assets, IP addresses or employees that they were not aware of. They are interested in general in understanding the reputation risk and looking at what might prompt a cyber-attack, and what parts of the world are likely to be affected and how it changes over time. Demo? yes – but not necessarily on their internal data."

“We have experienced and got traction with the bigger organisations where we find it easier – channels will have customers who realise that cybersecurity is more than a cybersecurity problem. We talk to CSOs and heads of threat intelligence, who are talking to IT suppliers about the obvious parts. But beyond the basics, they [resellers]are a bit at a loss.”

“We just want to allow customers to see things more quickly and more clearly. Intelligence is often a data problem – there are internal and external sources, and most organisations focus on internal structured date, yet the executive management is more worried about what is happening in the external unstructured world – where there is just so much data.”

Several large partners have already signed up, and others are sought, but the partners do not have to be huge – they could be a boutique reseller with a particular expertise and use case, he says.

The potential vertical markets are clear– financial services, reputation-damage-vulnerable retail, then the energy sector. “There is a lot going on in the consultancy space that we can be subcontractors to. Silobreaker can be a cog in the wheel. Large organisations are realising that it is more than an IT problem and need more tools,” he concludes.