Cisco, with 95% of its global workforce now working from home, saw its share price slip slightly after its Q3 results this week. The crisis had an impact on its financial results and business operations for the quarter, especially in the supply chain where we saw manufacturing challenges and component constraints. Total revenue was $12bn, down 8%. Non-GAAP operating margin rate was 34.9%, up 2.7 points. Non-GAAP net income was $3.4bn, down 2% year-over-year.

Total product revenue was down 12% to $8.6bn with infrastructure platforms down 15% as the area that was most impacted by the supply chain challenges.

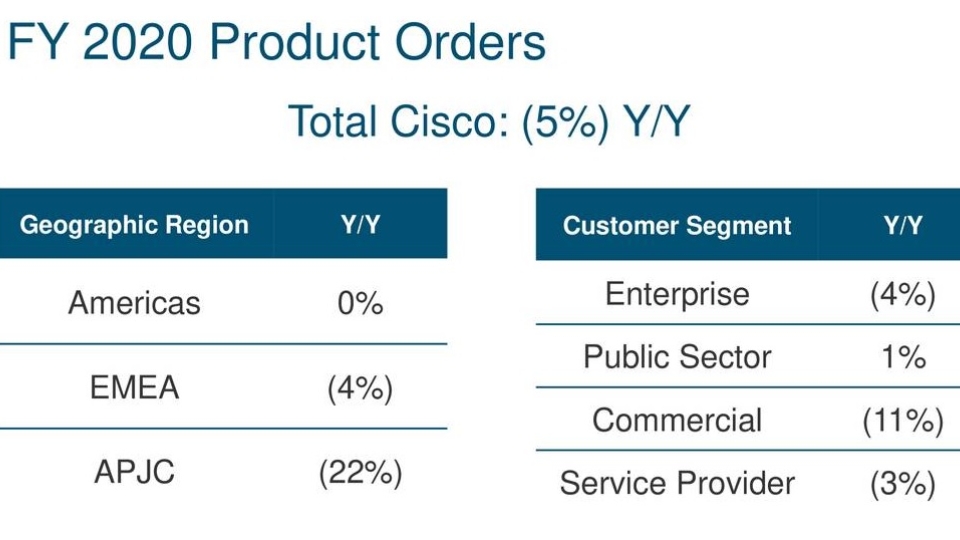

Switching revenue declined in both Campus and Data Centre. Routing declined in both service provider and in enterprise, it says. Applications was down 5%, driven by a decline in Unified Communications and TP end points. Security was up 6% with strong performance in unified threat management, identity and access and advanced threat. In geographies, the Americas was flat, EMEA was down 4% and APJC was down 22%. Total emerging markets were down 21% with the BRICS plus Mexico down 29%.

In customer segments, public sector was up 1%, while enterprise was down 4%, commercial was down 11% and service provider was down 3%.

CEO Chuck Robbins confirmed a $2.5bn financing deal with a new Business Resiliency Program through Cisco Capital to offer financial flexibility aimed at giving customers and partners access to technology they need now, invest for recovery and defer most of the payments until early 2021.

“In March, we were performing ahead of our expectations, as companies focused on building resiliency in their IT environments. Then in April we began to see a slowdown across the business, as countries across the world were locked down.”

“We believe the transition in our own business model through our shift to more software and subscription-based offerings is paying off. We saw continued strong adoption of our SaaS-based offerings and now have 74% of our software that is subscription versus 65% a year ago.”

“With the world going online practically overnight, the demand on networks has never been greater, with users looking for secure connectivity, reliable performance and consistent experiences. This has led to our customers evaluating how to expand their capacity quickly, how best to protect their teams and how to keep their data secure, while keeping their business productive.”

For industries like healthcare, public services, financial services and service providers especially, having network infrastructure tightly integrated with security is mission-critical, he says.

“We are now running our Webex platform at three times the capacity we were running at in February to manage the dramatic increase in usage growth. We had well over 500 million meeting participants, generating 25 billion meeting minutes in April, more than tripled the volume in February.”