Could the current crisis provide a stimulus for Europe fledging tech companies? While it is hard to see how collapsed markets and tough customer communications while in lockdown can provide any sort of foundation, there are some positives for some sectors, according to some strategists.

Research by EC- backed EuropeanStartups.co says that several thousand European tech businesses are vulnerable in the current crisis, with newer companies particularly at risk. Many startups are losing revenues and their values have fallen by as much as 30%, it says.

The insights into the impact on the European early stage tech sector are published to coincide with the launch of European Startups, a project aimed at propelling Europe's startup economy to the next level through online data, research and events. The project’s inaugural report, “What does it take? How can Europe’s startup ecosystem recover from the current crisis”, looks at how fit the ecosystem is to withstand the unprecedented crisis, which threatens hundreds of thousands of jobs across the 27 EU states.

Pēteris Zilgalvis, Head of Unit for Digital Innovation and Blockchain in the Digital Single Market Directorate and Co-Chair of the European Commission FinTech Task Force, said: “In just three weeks Europe has effectively shut down much of the infrastructure that it has taken for granted for decades. This change is both destroying traditional business models and creating new opportunities, often for emerging tech companies.”

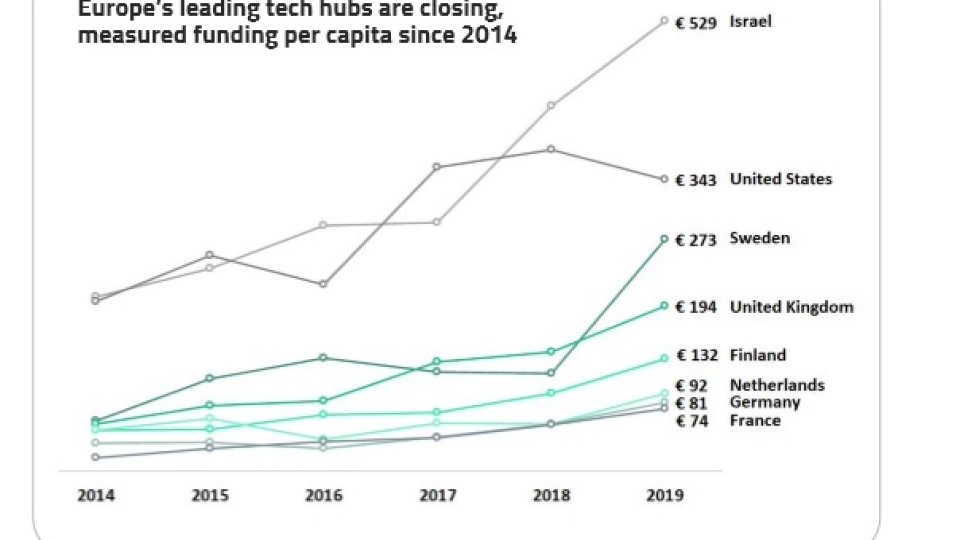

“Right now we need to identify the opportunities for and correctly understand the threats to European startups so that we can create policy and make decisions that help to continue the progress that has been made in recent years to create a healthy, ambitious tech sector across the EU-27. Fortunately the European tech ecosystem faces this crisis from a position of strength, having raised record levels of capital in 2019 and demonstrated strong levels of growth. The coming months will be a huge challenge to the startup sector, but it is more than capable of rising to it.”

Analysis of Europe’s 18,000 venture capital-backed companies suggests that the businesses fall into one of four categories: those for whom the crisis is net positive (food delivery, healthtech, logistics and collaboration tools including video conferencing); those for whom it is defensible (frontier tech, gaming, streaming, martech and fintech companies); those who are vulnerable (lending, proptech and fashion tech): and those who are most affected (travel tech and mobility). Dealroom.co estimates that one third (6,000) of European tech companies fall into the most affected and vulnerable category, while roughly half (8,600) will fall into the defensible category and a fifth (2,600) are likely to see net benefits.

The challenges for each category are starkly different. Companies for whom the crisis is net positive will also have to manage rapid growth and respond effectively to surging levels of demand while maintaining supply chains and customer satisfaction. For the majority of companies in the middle category, there will be operational challenges, a shrinking lead pipeline, heightened cash awareness and runway worries. In the most affected category (14%), companies could see revenue fall to zero and in some cases may collapse.

Jonathan Simnett, from tech M&A experts Hampleton Partners, and a well-received speaker at the Managed Services Summit says: “Clearly the EU - along with all its member governments - is facing an upping of the stakes in the perennial problem of government technology policy – that of picking and nurturing winners.”

It’s clear that all parts of the technology ecosystem have seen the opportunity to massively lobby governments across the EU for financial assistance during this crisis and the startup – as opposed to scaleup – lobbying has started later in its efforts. But now even business angels are joining the throng in making the case for `special treatment` he says.

But the key differentiating factor between scaleups and startups is that the vast majority of the latter fail and UK government support in the past has focussed on increasing the volume of creation of startups through measures such as R&D credits, sponsoring academic/industry collaboration, EIS, SEIS schemes and so on.

The business of investing in, as opposed to promoting, startups is, by its nature, high risk and casino-like in its nature because of the unknowns involved in doing it. Those that do it do it knowingly and willingly in the hope of hitting it big with at least one investment and losing on the rest (an activity well subsidised by EIS/SEIS schemes).

“To further distort the economy by supporting companies especially to what will be, for the most part, almost certain death is a questionable policy at a time when UK government, in particular, has evolved policy from picking potential winners to backing already demonstrable winners would be hard to argue,” he says.

After all, like every other business, startups can furlough their employees at 80% of salary and ride out the storm.

“This exceptionally generous measure could turn out to provide one of the most fertile periods for the thinking that goes into the formation of genuinely innovative companies that may be able to support the real changes that will need to be made in EU economies post-COVID if they are not to continue to pursue the types of growth driving climate change which, if gone unchecked will make COVID-19 look like a (pre-lockdown) walk in the park.”

“But, looking at the report classification it cites those who are vulnerable (lending, proptech and fashion tech): and those who are most affected (travel tech and mobility). Are these perhaps the sectors which will be playing their part in driving us to a greater catastrophe and can afford to be `let go`?

“As the reports states, the winners in the time of COVID are clearly food delivery, healthtech, logistics and collaboration tools including video conferencing and be `defensible` cited as frontier tech, gaming, streaming, martech and fintech companies. It will also be those can pivot fast and successfully.”

Clearly, we are seeing a Darwinian sorting and the majority of these and firms in energy, biotech, agritech, biotech and so on and the IT firms that support them can be the cohort to deliver technologies that will help assure our future so could be supported and prove COVID-19 was a crisis that did not go to waste.

“As for the argument that that EU countries have failed to produce an IT company of the scale and influence of an Apple, Facebook, Google or IBM so have to keep investing publicly to keep up momentum in the hope that someday they do but I think history has demonstrated that would be throwing good money after bad – as well as confirming a continuing failure to grasp the conditions that caused the innovation supercluster of Silicon Valley to arise. It also demonstrates and obsession with the past, not a vision for the future, “ he concludes.