Tech Data’s Q1 results show move to higher margin as it warns of a potential slowdown, especially in Europe.

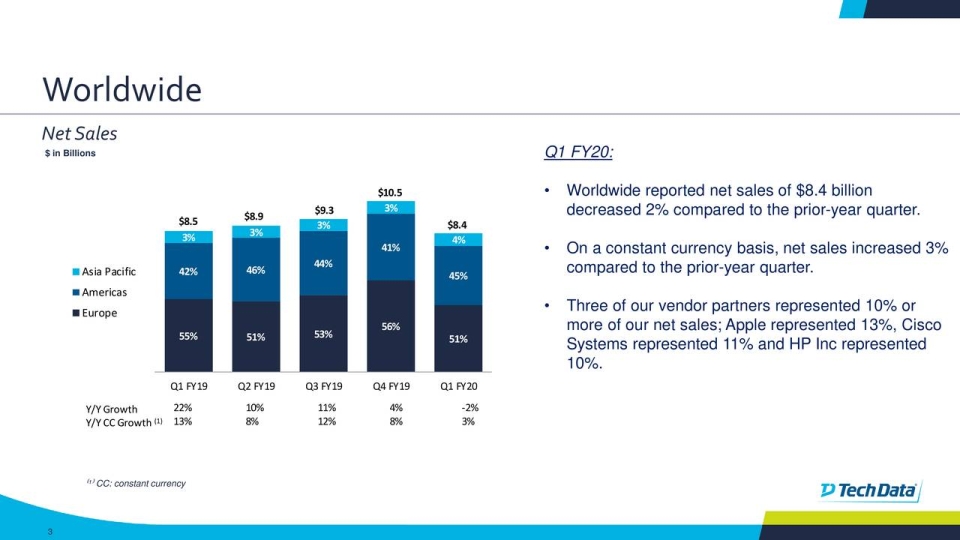

Tech Data Q1 worldwide sales were $8.4bn, a decrease of 2%. Adjusting for the impact of currency sales grew 3% in line with the midpoint of the guidance range, it says. Q1 worldwide gross profit was $509m, a decrease of $14m or 3%.

In Europe, sales of $4.3bn declined 8%. Excluding the impact of currency sales increased 1%. The sales growth in constant currency was driven by growth in cloud, networking, and security as well as mobility and servers, it says. Europe's non-GAAP operating income grew to $46m, an increase of 4% and up 14% on a constant currency basis and as a percentage of sales improved 12 basis points.

Tech Data’s Chief Executive Officer, Rich Hume: “Looking ahead although the IT market growth has slowed somewhat from a year ago demand continues to be solid and we remain positive on the overall IT spending outlook. We continue to closely monitor the global macro-economic issues and are confident in our ability to adjust relatively quickly given our flexible business model. In addition as we move through the year we will continue to be diligent in our portfolio optimization actions.”

“Anecdotally we feel as if Europe is a bit softer than the other markets. North America still is growing not quite as much as last year but it's a pretty solid growth.”

“Our worldwide teams executed well in the quarter despite the backdrop of concerns around BREXIT, global trade relations, and semiconductor shortages among others. While many of these macro-economic concerns remain, it is clear that the requirement for businesses of all sizes to digitally transform. As a reminder our four-pillar strategy includes investing in next generation technologies, strengthening our end-to-end portfolio, transforming Tech Data digitally, and optimizing our global footprint. We summarize our strategy as moving to higher value.”

“Throughout the organization there are a number of strategic and operational initiatives underway to accelerate the move to higher value, he says.” We are enhancing our business by digitizing processes to automate tasks and enable our teams to make decisions faster, operate more efficiently, and work more collaboratively. We are optimizing our portfolio by focusing on exchanging low return business for higher return business. In Q1 our heightened focus on portfolio optimization is evident in our year-to-year improvement in cash flow from operations and higher return on invested capital. And we are investing more than ever before in our people who we consider to be the engine of our business and the foundation of our strategy. During Q1 we introduced a number of tools, training and development programs designed to ensure that all of our colleagues continue to have the excellent skill sets needed to keep pace with a rapidly changing business and technology landscape.”