International IT services firm Computacenter has reported a very modest increase in group sales for the half-year ended 30 June, while at the same time announcing the acquisition of an IT services firm in Canada which has sales of $1.2bn.

Total revenues grew 1.5% to £2.46bn, which included a very slight drop in services revenue of 0.2% to £594m. “Significant reductions” in expenditure from industrial customers were offset by new business within the government and financial services sector, said the company.

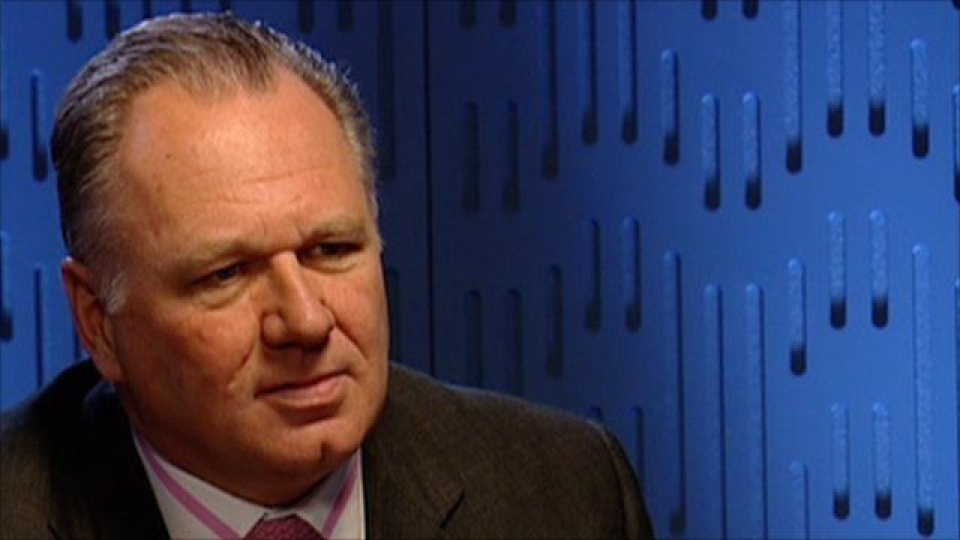

The profit before tax jumped 42.5% to £72m. Mike Norris (pictured), chief executive of Computacenter, said: “Our business has performed well this year to date and proven to be flexible in these extraordinary times. While nothing can be taken for granted, it is the board's view that, based on current business activity levels, our adjusted profit before tax for the year is unlikely to be less than £180m.

“Our markets have proved resilient as our customers have invested in their infrastructure to support their businesses, they have utilised the skills of our people and we have managed our cost base.”

As the results were released the market was informed that Computacenter had agreed to acquire the entire issued share capital of Pivot Technology Solutions for CA$105.8m (£62m). The company is listed on the Toronto Stock Exchange and the offer has the unanimous support of Pivot's board.

For a $1.2bn turnover company, the purchase price may seem modest, but Pivot currently owes over $200m to creditors, and only made a modest US$21m pre-tax profit for the year-ended 31 December 2019.

Pivot currently generates around 85% of its revenues from customers in the US and the remainder from customers in Canada. It employs about 600 people in the US and 100 in Canada. Computacenter intends to integrate its existing US operations with Pivot, approximately doubling both its revenue and headcount in the US, it said.

Norris said of the deal: "We are pleased with our progress in the US, including the acquisition of Fusionstorm in 2018. Pivot represents an opportunity to increase our scale, geographic footprint and capabilities in the US. Additionally, Canada expands our total market opportunity and helps us meet the needs of international customers.”